Table of Contents

A well-crafted customer education program can drive product adoption, reduce churn, and improve overall satisfaction. Its success, however, largely depends on your ability to identify and address key training gaps.

If you’re looking to pitch the idea of customer education to stakeholders or are ready to start building a program, understanding customer needs is the foundation of your case.

You have two main sources of truth that will pinpoint you to the information you need: people within your company and, of course, your customers.

This article is the first in a series aimed to help you build a strong case for customer education and secure executive buy-in. It’s packed with actionable tips and an overview of useful tools so that you can launch your program as soon as possible.

Let’s dive into building the foundation of your pitch and your customer education program: identifying training needs.

The power of asking the right questions

Asking the right questions is the key to building a customer education program that actually works. It helps you focus on what customers really need instead of guessing or wasting time on things that don’t matter.

There are three key things you want to identify: what your customers struggle with, how they prefer learning about your product, and how their needs evolve over time.

Here is a list of useful questions to explore:

Now that you have a starting list of questions, it’s time to start working on gathering answers. The first place to look? Your teammates.

Talk with people across your organization

Nearly every department in your organization has valuable insights into customer behavior and interaction with the product. While some teams may have deeper knowledge than others, almost everyone can contribute meaningfully.

Want more actionable advice?

Download our ebook to get more tips on crafting a convincing pitch for customer education:

Collect customer feedback: popular methods and tools

Customer feedback is a reliable source of information for identifying customer education needs. First, let’s see the most common ways to collect feedback:

NPS & CSAT surveys

Net Promoter Score (NPS) surveys can gauge how likely customers are to recommend your product or service to others. An NPS survey is as simple as,

“On a scale of 1-10, how likely are you to recommend our product to others?”

Similarly, Customer Satisfaction (CSAT) surveys measure how happy customers are with your product or service or even a specific interaction.

“How satisfied are you with your experience today?”

“How satisfied are you with (product/feature)?”

Depending on the given score, a customer will either be considered a promoter (9-10), passive (7-8), or detractor (0-6). You can always ask a brief follow-up question to identify what they have specifically liked or disliked.

Although these types of surveys are rather superficial and don’t provide deep insights, they’re an excellent starting point for uncovering customer dissatisfaction and initiating more initiatives to identify the root of the problem.

Post-interaction surveys

Post-interaction surveys have a broader scope than NPS and CSAT surveys, which are focused on satisfaction and likelihood of recommendation.

By sending out a survey after support or sales interactions, you can ask more specific, targeted questions to uncover areas for improvement and receive suggestions from your customers.

You can choose closed questions to make it easier for customers to reply:

“On a scale of 1-10, how confident do you feel in using (product/feature) after this interaction?”

Or, open-ended questions to get more valuable insights and pinpoint areas where customers feel under-educated or confused:

“Was there any part of [product/feature] that you found unclear or challenging to understand during this interaction?”

You can also add follow-up questions in case you received a low score:

“What additional training or resources would help you feel more confident?”

“Please describe any areas where you feel additional support or training would be helpful.”

Focus groups

Though not as common or scalable as online surveys, focus groups allow for more in-depth discussions. You can create a focus group after major feature updates, when you want to understand the challenges and needs of specific user groups, or to dive deeper into the results of online surveys.

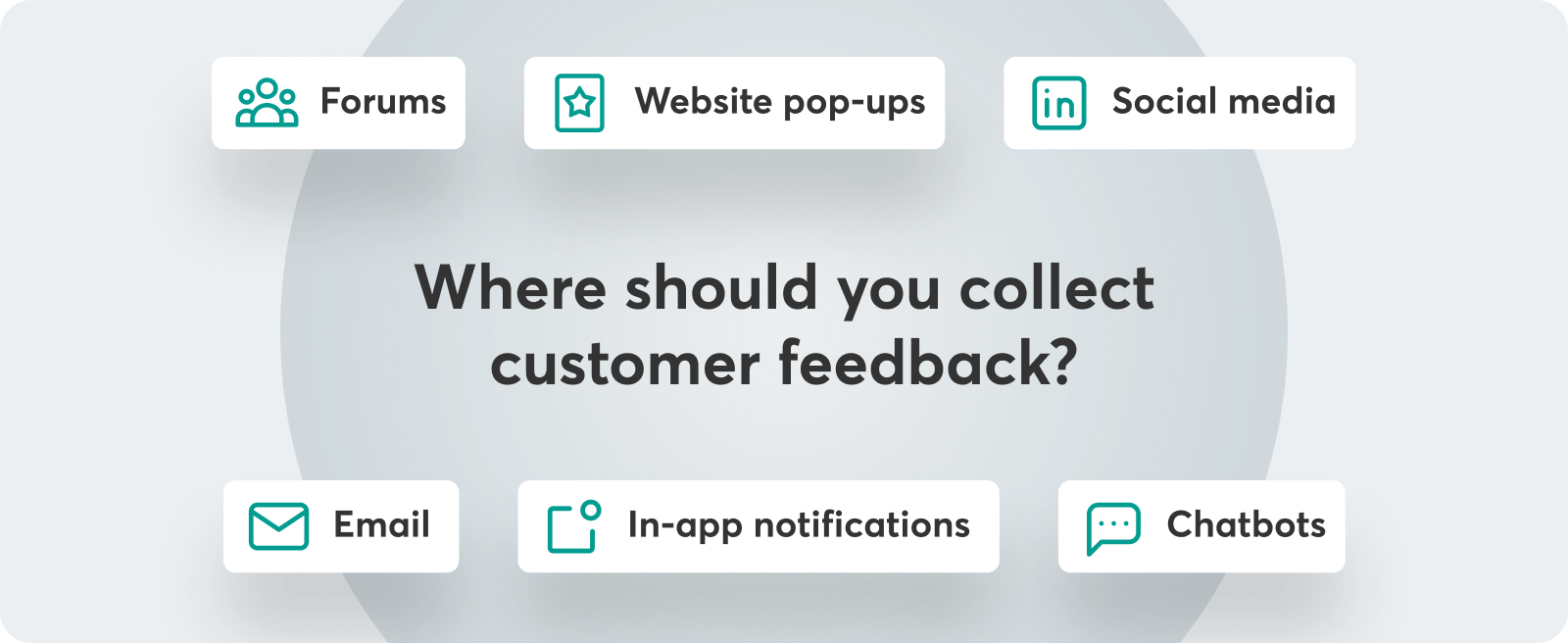

And how do you collect customer feedback?

Overview of customer survey tools

Using a survey tool is an efficient way to simplify feedback collection and streamline the process. At the same time, you’ll get access to eye-opening insights that will guide you toward customer friction points and challenges.

Key features of these tools include:

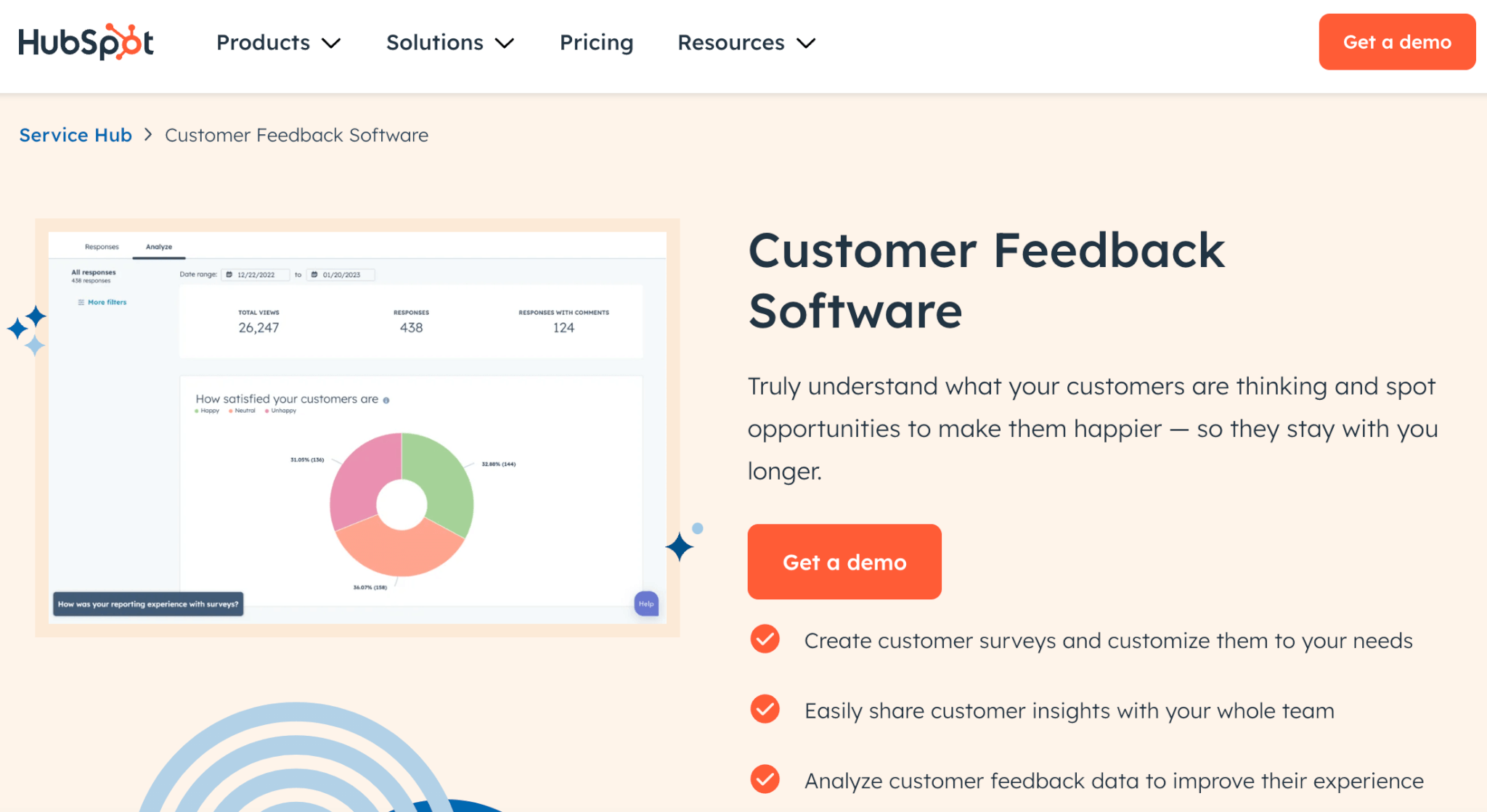

Hubspot

HubSpot customer feedback software is part of Hubspot’s Service Hub and allows you to create customizable surveys that you can share via web link or email. The tool provides pre-built templates for net promoter score (NPS), customer effort score (CES), and customer satisfaction (CSAT) surveys, and feedback dashboards to monitor customer loyalty over time.

Starting price: €100/mo/seat (as a part of Service Hub Professional)

SurveyMonkey

SurveyMonkey features prebuilt templates for various surveys that you can share through emails, links, websites, desktop apps, or mobile apps. It’s powered with AI, allowing you to build and analyze survey responses faster and more accurately. Features include embedding questions into email previews and a dashboard for analyzing responses. It integrates with popular CRMs and email software.

Starting price: €30/user/month

Survicate

Survicate features an intuitive drag-and-drop survey creator and enables you to distribute surveys through emails, links, websites, desktop apps, or mobile apps. Features include embedding questions into email previews, AI feedback analysis, and a dashboard for analyzing responses. Survicate also integrates with various CRMs and email software, enabling you to

send your survey with just one click.

Starting price: free

SurveySparrow

SurveySparrow is an advanced survey software for multiple use cases and survey types. It allows you to collect feedback via sms, email, WhatsApp, slack, and more channels. It features AI data analysis and survey creation. Another standout feature is SpotChecks, that allow you to get contextual micro-feedback across websites and mobile apps.

Starting price: not disclosed.

And what about tracking and analyzing customer behavior within your product?

Use product analytics tools

Since actions speak louder than words, there’s no harm in using additional assistance from tech tools to find out what customers won’t tell you.

Product analytics tools can help you understand user interactions with your product and help you make informed, data-driven decisions to enhance user experience and drive growth through targeted training resources.

Key functionalities of these tools include:

Below, you can find the most popular tools our team tested.

Mixpanel

Mixpanel is a reliable product analytics tool that focuses on tracking user interactions and behaviors within your product. It offers an in-depth analysis of user actions, enabling you to understand how users engage with specific features and identify areas for improvement.

Starting price: free

Amplitude

Amplitude provides comprehensive analytics to help businesses understand user behavior and optimize retention. With features like event segmentation and cohort analysis, you can delve deep into user interactions and make data-driven decisions.

Starting price: free

Heap

Heap automatically captures all user interactions within your product, providing a complete dataset without the need for manual event tracking. This allows for flexible and in-depth analysis of user behavior and product usage patterns.

Starting price: free

Pendo

Pendo combines product analytics with user feedback and in-app messaging, helping businesses understand user behavior and improve feature adoption. It also offers tools for managing customer feature requests and onboarding and AI-generated insights.

Starting price: not disclosed.

Perform usability testing

One more effective, even if less scalable and quite time-consuming, method to identify areas where customers need support is to conduct usability testing. Real-time observation and the think-aloud protocol are two popular methods to perform usability testing.

Real-time observation

During usability testing sessions, real customers attempt to use key features of your product while being observed by a product or UX team. Watch for moments where they hesitate or make mistakes.

Think-aloud protocol

Ask users to vocalize their thought processes as they interact with your product to uncover confusion or misunderstanding that may not surface in silent observation. When users struggle to explain a process, it suggests a potential need for clearer education or training.

Helping your customers starts with understanding them

Figuring out what your customers need is the first step to making a strong case for customer education. By tapping into insights from your team and listening to your customers, you can shape a program that aligns with your business goals and fills the gaps holding you back.

This isn’t just about creating better training—it’s about showing stakeholders the tangible value of customer education and proving why it deserves to be a top priority.

Want to learn more? Get the full scoop in our ebook now.

Further reading

Androniki Koumadoraki

Androniki is a Content Writer at LearnWorlds sharing Instructional Design and marketing tips. With solid experience in B2B writing and technical translation, she is passionate about learning and spreading knowledge. She is also an aspiring yogi, a book nerd, and a talented transponster.